Ein Buch für erfahrene Experten auf dem Gebiet der Kreditderivate. "Credit Derivatives Pricing" erläutert Theorien und Methoden zur Ermittlung des Kreditrisikos und zur Preisbildung bei Kreditderivaten. Darüber hinaus enthält es zur Vertiefung der Kenntnisse einen umfassenden praktischen Teil. Hier erklärt der Autor - ein erfahrener Consultant und Experte auf dem Gebiet der Kreditderivate - sehr detailliert und anschaulich Anwendungsbeispiele zu den behandelten Theorien und Methoden.

"Credit Derivatives Pricing": Ein wichtiges Buch für die tägliche Praxis.

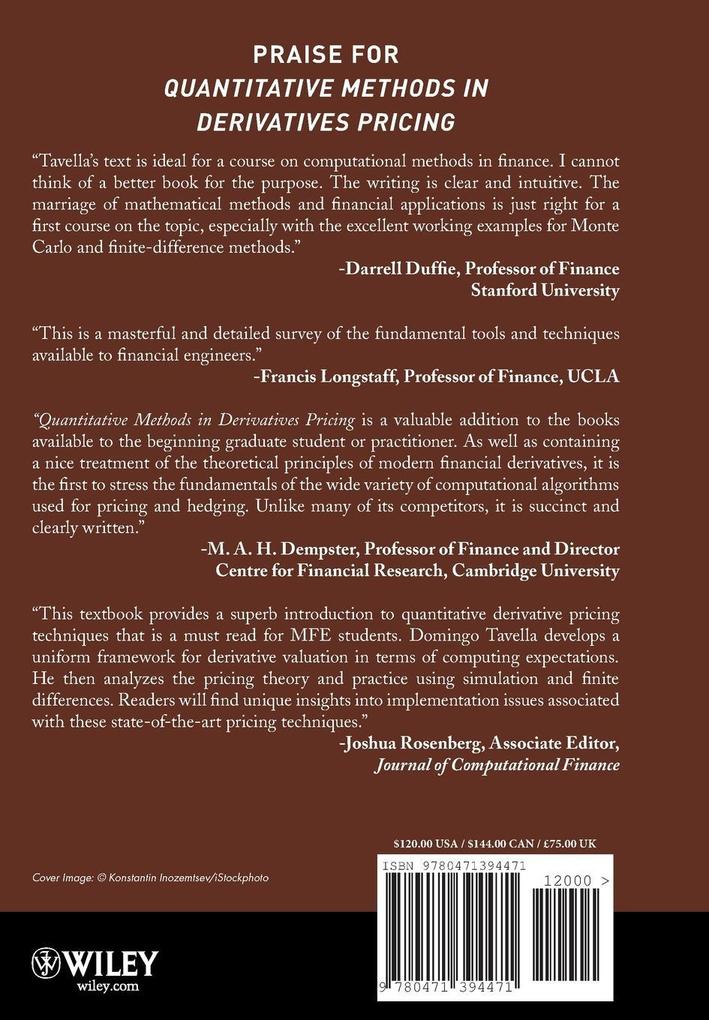

Praise for Quantitative Methods in Derivatives Pricing

"Tavella's text is ideal for a course on computational methods in finance. I cannot think of a better book for the purpose. The writing is clear and intuitive. The marriage of mathematical methods and financial applications is just right for a first course on the topic, especially with the excellent working examples for Monte Carlo and finite-difference methods."

-Darrell Duffie, Professor of Finance

Stanford University

"This is a masterful and detailed survey of the fundamental tools and techniques available to financial engineers."

-Francis Longstaff, Professor of Finance, UCLA

"Quantitative Methods in Derivatives Pricing is a valuable addition to the books available to the beginning graduate student or practitioner. As well as containing a nice treatment of the theoretical principles of modern financial derivatives, it is the first to stress the fundamentals of the wide variety of computational algorithms used for pricing and hedging. Unlike many of its competitors, it is succinct and clearly written."

-M. A. H. Dempster, Professor of Finance and Director

Centre for Financial Research, Cambridge University

"This textbook provides a superb introduction to quantitative derivative pricing techniques that is a must read for MFE students. Domingo Tavella develops a uniform framework for derivative valuation in terms of computing expectations. He then analyzes the pricing theory and practice using simulation and finite differences. Readers will find unique insights into implementation issues associated with these state-of-the-art pricing techniques."

-Joshua Rosenberg, Associate Editor, Journal of Computational Finance

Inhaltsverzeichnis

Arbitrage and Pricing.

Fundamentals of Stochastic Calculus.

Pricing in Continuous Time.

Scenario Generation.

European Pricing with Simulation.

Simulation for Early Exercise.

Finite Differences.